The FinTech landscape is evolving rapidly, and with it, so are the strategies for with prospects and generating leads. In this fast-paced, competitive industry, it’s essential to stay ahead of the curve and utilize innovative tactics to attract key decision makers and convert good-fit prospects into potential FinTech buyers.

Are you ready to unlock revenue growth and gain a competitive edge in your FinTech buying process?

This blog post will guide you through 11 powerful FinTech lead generation strategies that can help you achieve sustainable growth and success.

Short Summary

-

Understand the FinTech landscape, leverage technology for lead generation, and navigate regulatory environment to maximize success.

-

Build a strong digital presence through website optimization & social media engagement. Utilize content marketing strategies such as blogging & podcasts.

-

Harness SEO power with keyword research & on/off page optimization, use Fintech social media advertising tactics, implement email campaigns with personalization/segmentation automation/analytics, utilize referral programs and affiliate marketing opportunities, network at industry events to generate leads.

Understanding the FinTech Landscape

FinTech companies operate in a dynamic landscape shaped by technology advancements and regulatory environments, which have a direct impact on the prospects of a company and lead generation program.

Navigating this complex terrain requires specialized tactics to address the unique business challenges that arise and acquire high-quality leads. A skilled sales and marketing and sales team, is essential in this process.

In this ever-changing ecosystem, FinTech companies must adapt their digital marketing and strategies to stay relevant and attract the right audience. This requires a deep understanding of the industry, the target audience, and the competitive landscape. Companies must also be agile and responsive to changes in the market, as well as the needs of their customers. By leveraging the right assets.

The Role of Technology

Technology has revolutionized the financial services industry, enabling automation of financial operations, enhancing customer experience, and reducing operational costs. Moreover, user data plays a critical role in FinTech lead generation strategies, helping companies identify industry trends, search patterns, and potential customers.

As technology continues to shape the FinTech landscape, businesses must stay abreast of the industry trends latest advancements and leverage them to drive measurable lead generation results.

Regulatory Environment

The regulatory environment is a complex web of rules and guidelines governing FinTech operations, affecting the sales and marketing team’s approach and influencing the very lead generation for fintech and many fintech companies, businesses and buyers’ choices and preferences. It varies from country to country and, in the US, is subject to both state and federal regulations.

Understanding and adapting to the regulatory environment is crucial for FinTech companies to ensure compliance, minimize risks, and generate higher quality leads.

Building a Strong FinTech Digital Presence

A strong, digital marketing presence is essential for FinTech and lead gen. generation marketing strategy, as it provides the opportunity to attract and convert leads.

This involves creating a visible and accessible online presence that facilitates communication between businesses and consumers, enhances brand recognition, and encourages engagement with current and potential customers.

In this section, we will explore the importance of website optimization and social media engagement for building a solid, digital marketing presence and driving successful lead generation.

Website Optimization

Optimizing your website for user experience, conversions, and SEO is crucial for attracting and converting leads. User insights are essential for addressing and satisfying user requirements, and can optimize the return on investment from PPC campaigns and paid social activity.

By consistently optimizing landing pages on your website’s landing page, you can ensure a constant influx of new organic leads, and have the landing page do more and more of the work for you.

Social Media Engagement

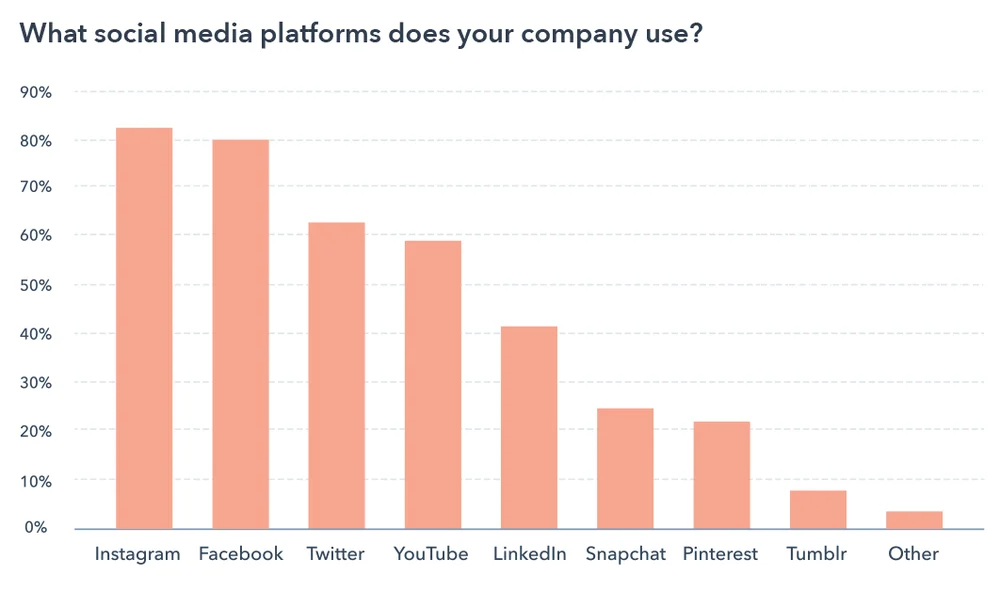

Engaging with your audience on social media platforms is vital for building brand recognition and trust, ultimately enhancing lead generation. By crafting captivating and compelling content yourself, incorporating visuals, responding to comments and messages, and leveraging influencers, you can boost social media engagement and amplify the reach of your social accounts and content.

It’s important to maintain consistency, actively participate in conversations with followers, and utilize analytics to evaluate performance and maximize social media engagement.

FinTech Firm Content Marketing Strategies

Effective content marketing and lead gen strategies that, such as blogging and thought leadership, webinars, and podcasts, can help FinTech companies attract and nurture leads.

When your FinTech marketing team is crafting valuable and relevant content, and connecting effectively with the target audience, you can maximize the chances of attracting, engaging, and converting leads using lead generation strategies.

In this section blog articles, we have blog articles that will delve into the power of content marketing strategies for FinTech and how they can contribute to the success of your account based marketing and lead generation campaigns.

Blogging and Thought Leadership

Blogging create content, and thought leadership are powerful tools for establishing authority, building trust, and educating potential leads. By creating and sharing high-quality, compelling content on relevant topics, you can position your brand as a thought leader in the FinTech space and foster customer confidence.

One example of a successful FinTech company that leverages blogging to engage and inform potential clients is Stash, which offers a repository of blog content covering securities lending, high-dividend stocks, and other investment and retirement-related topics.

Webinars and Podcasts

Webinars online, virtual events, and podcasts are effective content marketing strategies that provide valuable information and engage audiences, generating leads and nurturing relationships. By hosting webinars online events virtual marketing events, FinTech companies can showcase their expertise, engage with potential leads, and build relationships with their target audience.

Participating actively in conversations on various social media channels through social listening can also help generate higher quality leads too, making webinars and podcasts valuable tools for FinTech lead generation.

Data-Driven Fintech Companies

Data-driven marketing plays an integral role in all lead gen strategies, enabling FinTech companies to target and convert leads more efficiently through a well-crafted sales funnel. By utilizing customer segmentation and predictive analytics, businesses can refine their marketing efforts and improve lead generation outcomes.

In this section, we will explore how a data-driven marketing strategy and lead generation strategy together, including customer segmentation and predictive analytics, can help FinTech firms achieve success in their lead generation campaigns.

Customer Segmentation

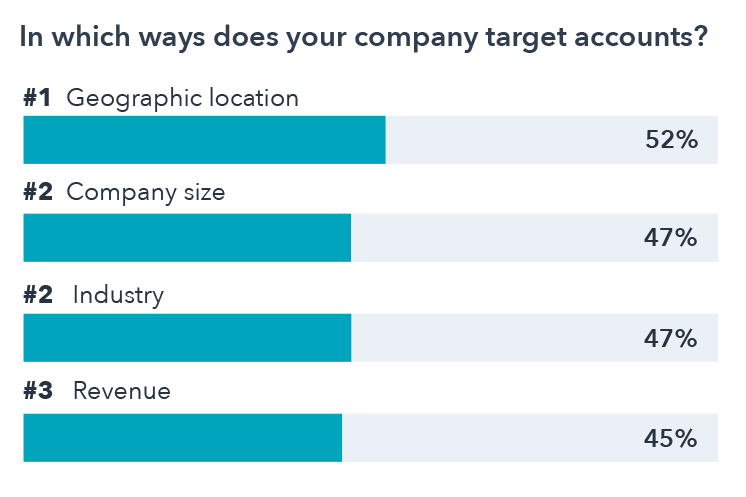

Segmenting customers based on demographics, behavior, and preferences is crucial for personalized marketing and better lead targeting. By dividing customers into distinct groups, FinTech companies can develop more focused sales and marketing strategies for each potential customer and group, ultimately increasing engagement and conversion rates.

Utilizing effective targeting options, trust factors such as demographic, interest, and behavior targeting, marketers can help FinTech brands reach their ideal customers and generate a steady stream of high-quality FinTech leads.

Predictive Analytics

Predictive analytics utilizes historical data, statistical algorithms, and machine learning techniques to predict the likelihood of future outcomes. By examining past data and recognizing patterns, FinTech companies can anticipate future results and make informed decisions to optimize marketing efforts and improve lead generation results.

Leveraging predictive analytics can help businesses identify trends, optimize marketing initiatives, and monitor customer engagement, ensuring that the right messages are being sent to the right people at the right time, across the FinTech buyer’s journey.

Traffic Driving FinTech

Search engine optimization (SEO) is essential for FinTech and lead generation strategy, as it drives brand awareness and provides high-quality organic leads and lead generation opportunities at minimal cost for advertising and promotion.

By conducting keyword research and optimizing on-page and off-page factors, FinTech companies can improve their search engine rankings and drive organic traffic to their websites, generating valuable leads through organic lead generation.

In this section, we will discuss the importance of SEO for FinTech companies and how harnessing its power can contribute to the success of their account based marketing and lead generation campaigns.

Keyword Research

Conducting keyword research is crucial for FinTech companies, as it enables them to target relevant search queries and attract potential leads.

When you are going through the tedious exercise of identifying popular search terms, examining their various search patterns, volume, competition, and relevance, and utilizing that information to optimize content for search engines, FinTech platforms can ensure their content is discovered by prospective customers.

Using keyword research data, businesses can optimize their content for search engine optimization, establish targeted ads campaigns, target accounts, and identify potential leads.

On-Page and Off-Page Optimization

Optimizing on-page and off-page factors is essential for improving search engine rankings, driving organic traffic, and generating leads. On-page optimization focuses on enhancing the content of a website to make it more visible to search engines, while off-page optimization involves building external links to increase its visibility and authority.

By optimizing on-page and off-page factors, FinTech companies can improve their search engine rankings and drive organic traffic to their websites, ultimately generating valuable leads.

Leveraging FinTech Social Media Advertising

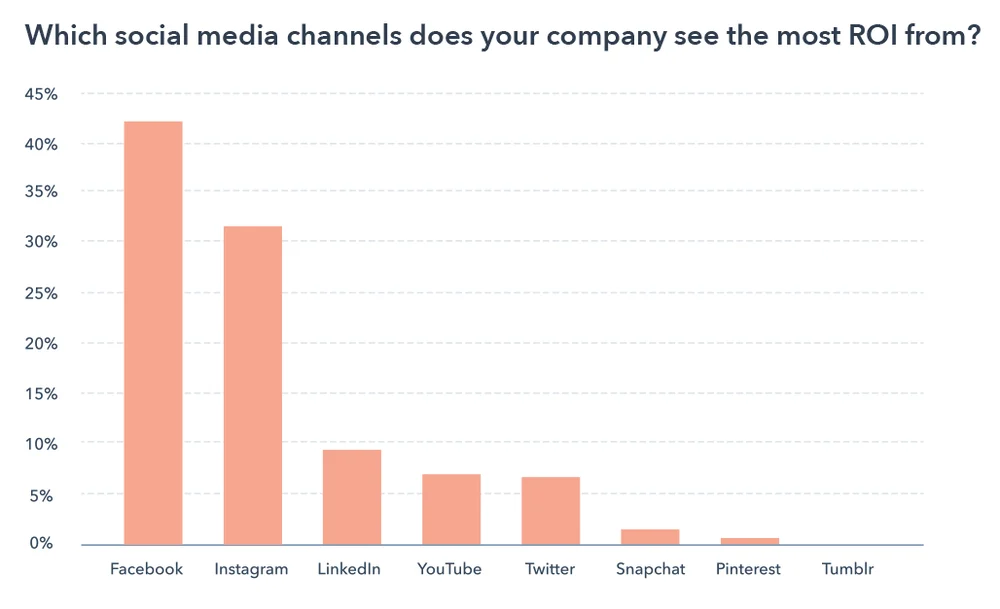

Social media advertising is an often cost effective way for FinTech companies to reach their prospects and convert leads. By utilizing targeting options and ad formats, businesses can create highly targeted ads that appeal to their company specific audience.

In this section, we will explore how leveraging FinTech social media advertising, including targeting options and ad formats, can help businesses reach and convert leads more effectively.

Targeting Options

Utilizing targeting options in social media advertising is crucial for FinTech companies to reach specific audiences and improve lead generation. By employing demographic, interest, and behavior targeting, businesses can create highly targeted ads that resonate with their ideal customers, ultimately increasing engagement and conversion rates.

Employing effective targeting options can help FinTech companies to generate great-fit leads from high-quality prospects and other marketers maximize their return on investment from fintech company lead generation campaigns on social media advertising.

Ad Formats and Creative

Choosing the right ad formats and creative elements is crucial for increasing engagement and conversions. Ad formats and creative for FinTech social media advertising include text ads, image ads, video ads, and carousel ads, which can be utilized to capture the attention of users and convey your message effectively.

By selecting the most suitable ad formats and creative elements, FinTech companies can create compelling ads that resonate with their target audience and drive organic lead generation.

Implementing FinTech Email Marketing Campaigns

Email marketing campaigns are a valuable tool for FinTech and lead generation strategy, as they enable businesses to engage with potential leads, share expertise, and build relationships with their target fintech buyers. By implementing personalization, segmentation, automation, and analytics, FinTech platforms can optimize their email marketing campaigns and drive results.

In this section, we will discuss the benefits of implementing FinTech email marketing campaigns and how they can contribute to the success of lead generation efforts.

Personalization and Segmentation

Personalizing and segmenting email campaigns can significantly improve engagement and conversion rates. Through understanding individual customer preferences and segmenting based on demographics, behavior, and interests, FinTech firms can create tailored messages that resonate with their target demographic and drive lead generation.

Implementing personalization and segmentation in email marketing campaigns can help FinTech companies nurture relationships with potential leads and increase the likelihood of converting them into paying customers.

Automation and Analytics

Automating email campaigns and analyzing performance data are essential for optimizing marketing efforts and driving results. Automation can facilitate the process of creating and sending emails, while analytics can provide insights into customer engagement and the performance of campaigns.

By leveraging automation and analytics, FinTech platforms can refine their email marketing campaigns, ensuring that the right messages are being sent to the right people at the right time, resulting in more cost effective lead generation playbook.

Utilizing Fintech Referral Programs and Affiliate Marketing

Referral programs create content, and affiliate marketing are powerful strategies for expanding reach and generating leads of prospective fintech buyers through partnerships and word-of-mouth.

By incentivizing existing customers to refer new leads and partnering with affiliates to create content to promote fintech lead generation campaigns, products, solutions lead generation for fintech, or services, FinTech firm can leverage these lead gen strategies to drive growth and success.

In this section, we will explore how utilizing FinTech company referral programs and affiliate marketing can help businesses generate qualified prospects, and achieve sustainable growth.

Setting Up Referral Programs

Setting up referral programs is an effective way to incentivize existing customers to refer new opportunities, driving growth for your FinTech business.

By defining objectives, deciding on rewards, constructing a landing page, selecting the necessary tools, advertising the program, and monitoring referrals and rewards, a FinTech firm can establish successful referral programs that help build customer loyalty and drive lead generation.

Utilizing referral programs can be a successful approach to increasing potential customer, loyalty, retention, and FinTech demand generation.

Partnering with Affiliates

Partnering with affiliates can help FinTech companies reach new audiences and generate qualified prospects, through trusted recommendations. By collaborating with other businesses or individuals to promote your products or services in exchange for a commission or other benefits, FinTech brands can expand their reach to target accounts and acquire new leads.

Establishing successful affiliate partnerships requires clear guidelines and expectations, regular communication, and providing incentives to motivate performance.

Networking and Fintech Industry Events

Networking and participating in FinTech industry events, such as conferences, trade shows, webinars, and virtual conferences, provide valuable opportunities to build connections, showcase products, and generate qualified leads that align with your FinTech ideal customer profile.

In this section, we will discuss the importance of networking and participating in FinTech industry events for lead generation and how they can contribute to your sales funnel and the success of your sales team, and marketing team in your business.

Attending Conferences and Trade Shows

Attending conferences and trade shows provides FinTech businesses with opportunities to network, showcase their products, and generate good-fit leads. By participating in these events, businesses can increase brand recognition, acquire good reputation and high quality leads from, and network with other professionals in the financial technology industry.

In order to maximize the benefit of attending conferences and trade shows, it is essential to establish objectives for the event, connect with other participants, interact with potential customers, and follow up post-event.

Hosting Webinars and Virtual Events

Hosting webinars and virtual thought leadership events is an often cost effective way for FinTech platforms to engage with qualified leads, share expertise, and build relationships with their target demographic. By creating engaging and relevant content, using visuals, providing incentives, and following up with attendees, FinTech brands can ensure successful webinars and virtual conferences that drive lead generation.

Engaging in social listening and actively participating in conversations on various social media channels can also help generate qualified prospects, making webinars and virtual lead generation events valuable tools for FinTech lead generation.

FinTech Lead Generation Takeaways

In conclusion, the lead generation for FinTech landscape is continually evolving, and adopting the right lead generation and account based marketing strategies is essential for starting conversations with targeted key decision makers, for sustainable growth and success.

By understanding the FinTech landscape, building a strong, digital marketing presence, leveraging content marketing, utilizing data-driven marketing solutions, harnessing the power of FinTech SEO. Additionally, leveraging social media advertising, implementing email marketing campaigns, utilizing referral programs and affiliate marketing, and networking at industry events, FinTech companies can unlock revenue growth and gain a competitive edge in the market.

The future of FinTech and the various lead gen next generation strategies next generation strategies of lead gen next generation lies in the hands of companies that embrace these FinTech lead gen strategies and adapt to the ever-changing client acquisition landscape to consistently nurture high quality leads.

Questions Around Fintech lead generation Campaigns

What are the 4 areas of fintech?

The four primary areas of the many fintech companies are payments, digital banking and financial services industry, cryptocurrencies, and digital wealth management.

Payments refer to the use of technology to conduct financial transactions, while digital banking and financial services industry involves the use of financial technology used to provide traditional banking services.

Cryptocurrencies, such as Bitcoin, involve the use of encryption technology to secure transactions, while digital wealth management refers to the use of technology to manage investments.

What are four 4 categories of users for fintech?

Fintech vendors caters to four main focus groups of users: B2B business, for banks and other financial institutions, business clients of fintech vendors those same organizations, B2C for solutions for small businesses, and finally direct consumers.

All these groups benefit from the advantages of fintech.

What are the 3 categories of fintech?

The three main categories of the fintech solution are digital banking, payments, and trading/cryptocurrency. These innovative fintech services and fintech solution and solutions help enable more convenient and efficient financial services for consumers and businesses alike.

How do you generate leads for financial products?

To generate sales qualified leads for financial products, marketers should focus on establishing an effective website presence, as well as engaging in SEO, content marketing, localized outreach, and social media advertising.

Additionally, it is important to stay up to date with industry best practices, such trust factors such as running online ads and following up on leads promptly.

What are the 5 types of fintech lead generation efforts?

Fintech, the combination of financial services and technology, is transforming the way businesses interact with their customers and manage their finances. The five most popular types of fintech services include payment processing services, investments, crowdfunding, blockchain, and lending.

Each type helps to improve SaaS marketing operations in different ways.